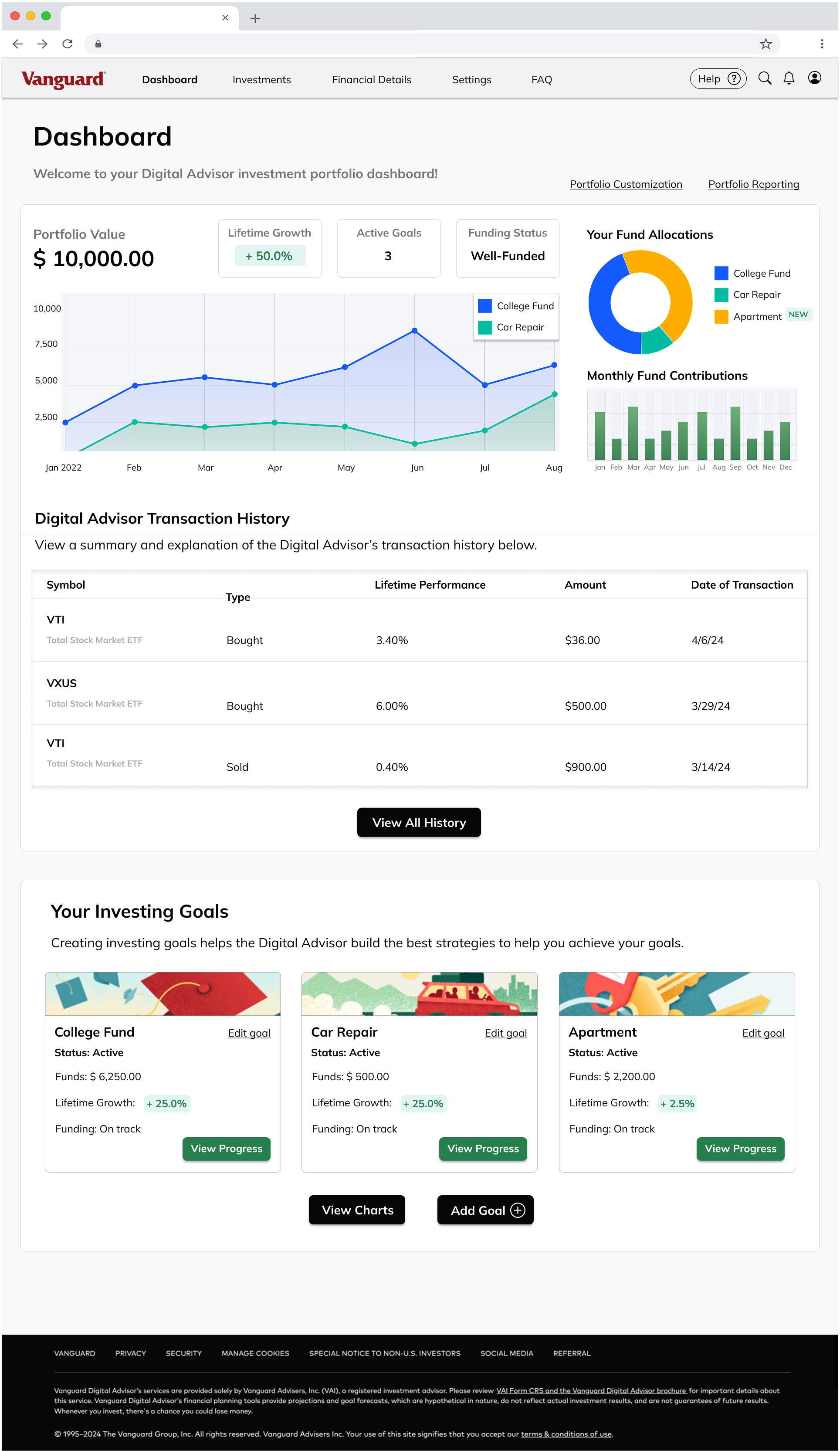

Vanguard: Rebuilding a Financial Dashboard

Conducting a comprehensive study and redesign for Vanguard's Digital Advisor (AI Investor) Dashboard.

| Role | Duration | Project Type | Tools/Skills |

|---|---|---|---|

| UX Researcher and UI Designer | 3 Months | Partnership | Domain and User Research, Figma, Cardsorting, Usertesting.com |

Summary

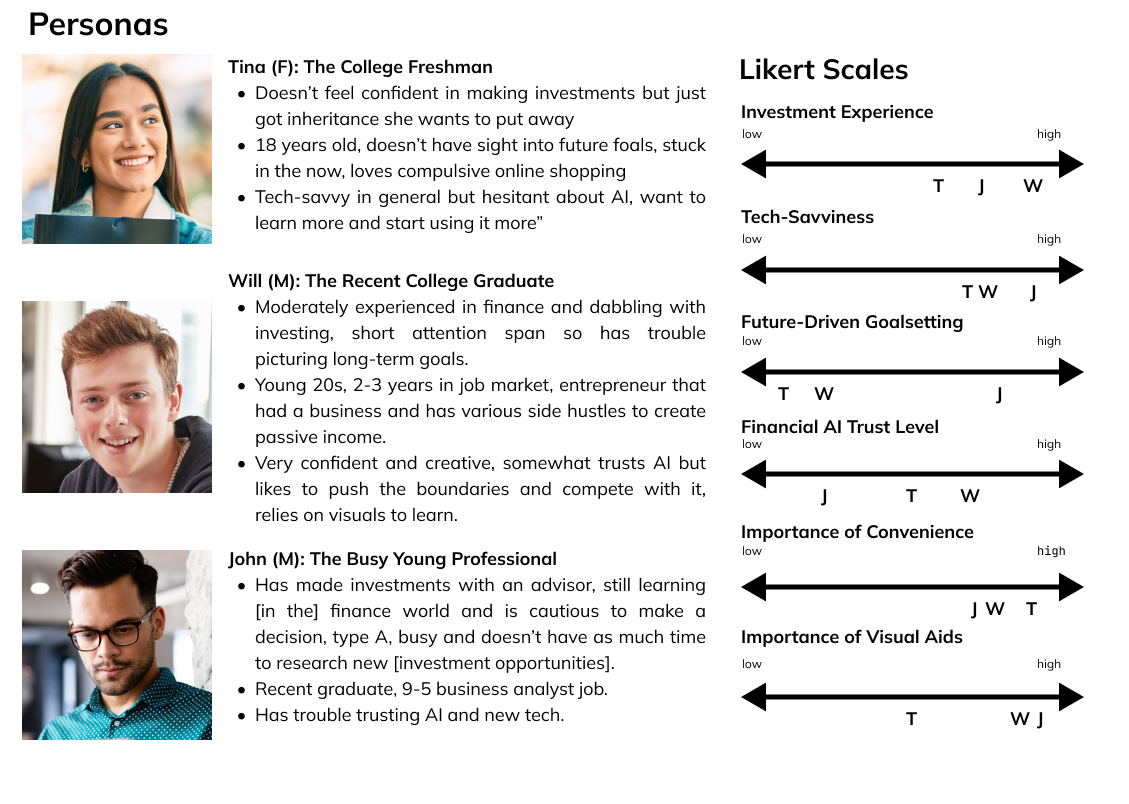

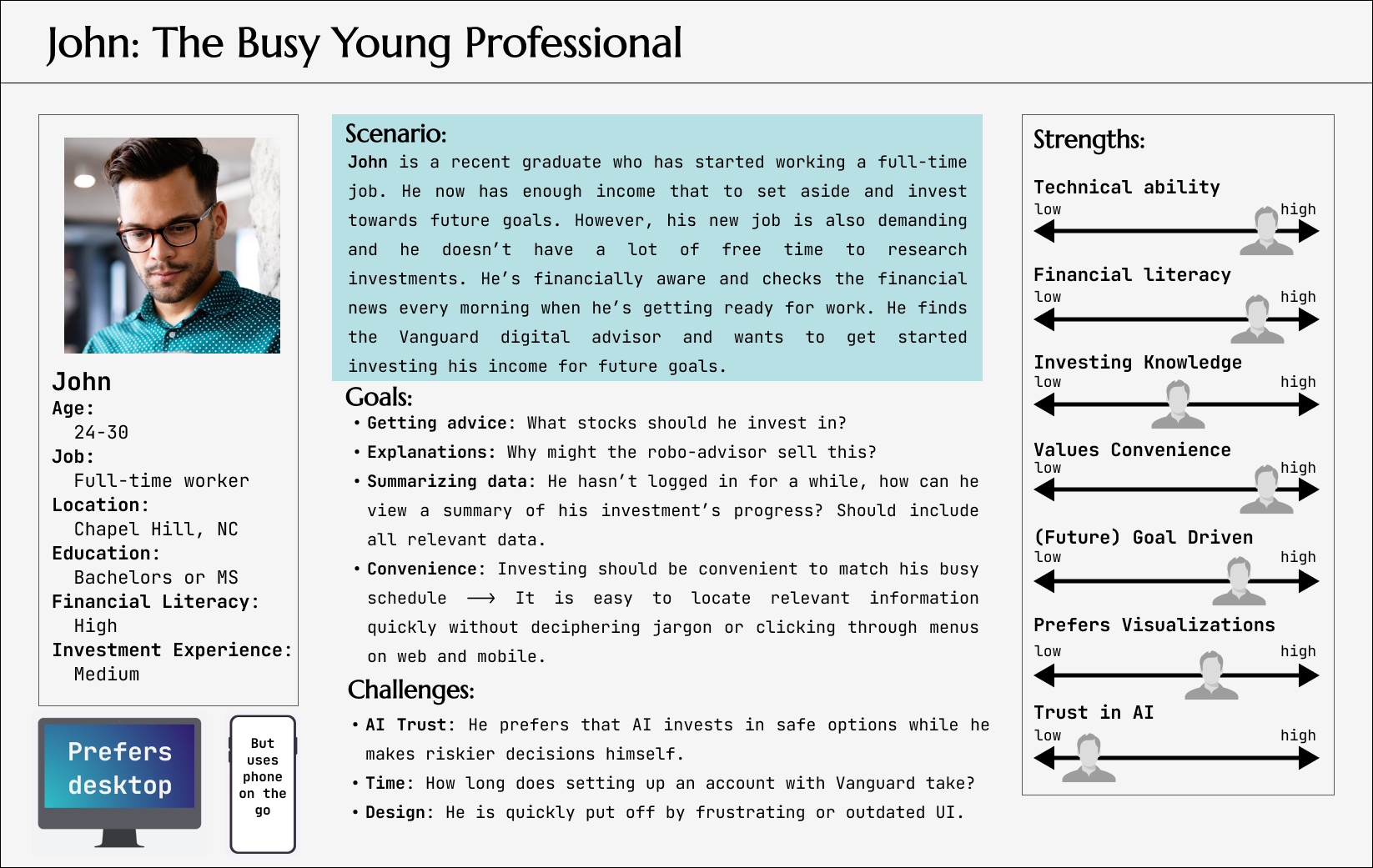

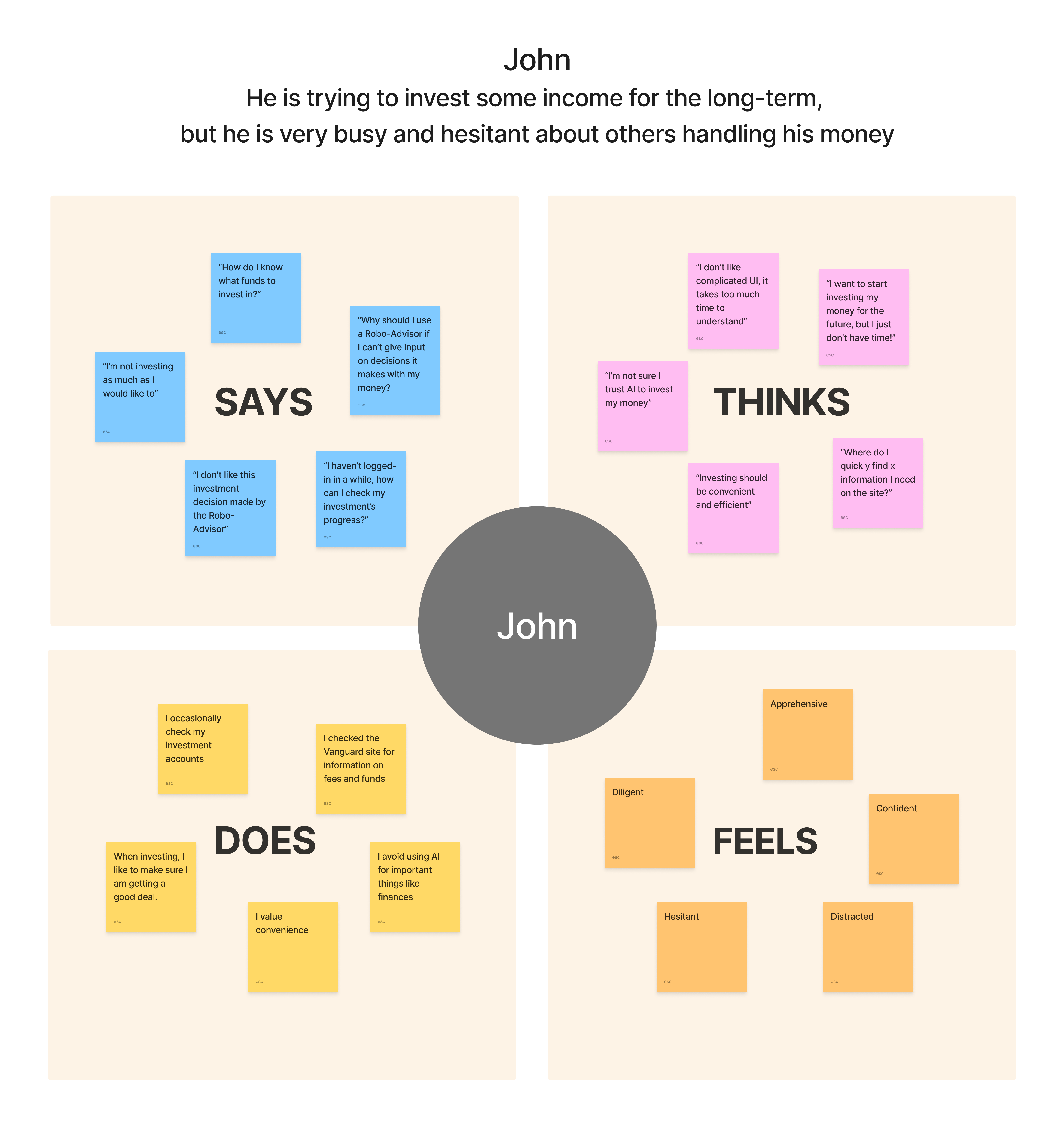

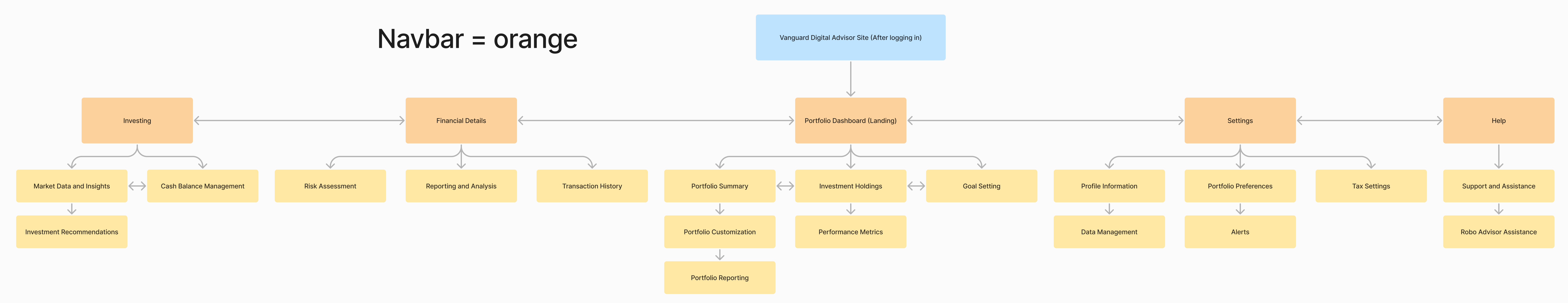

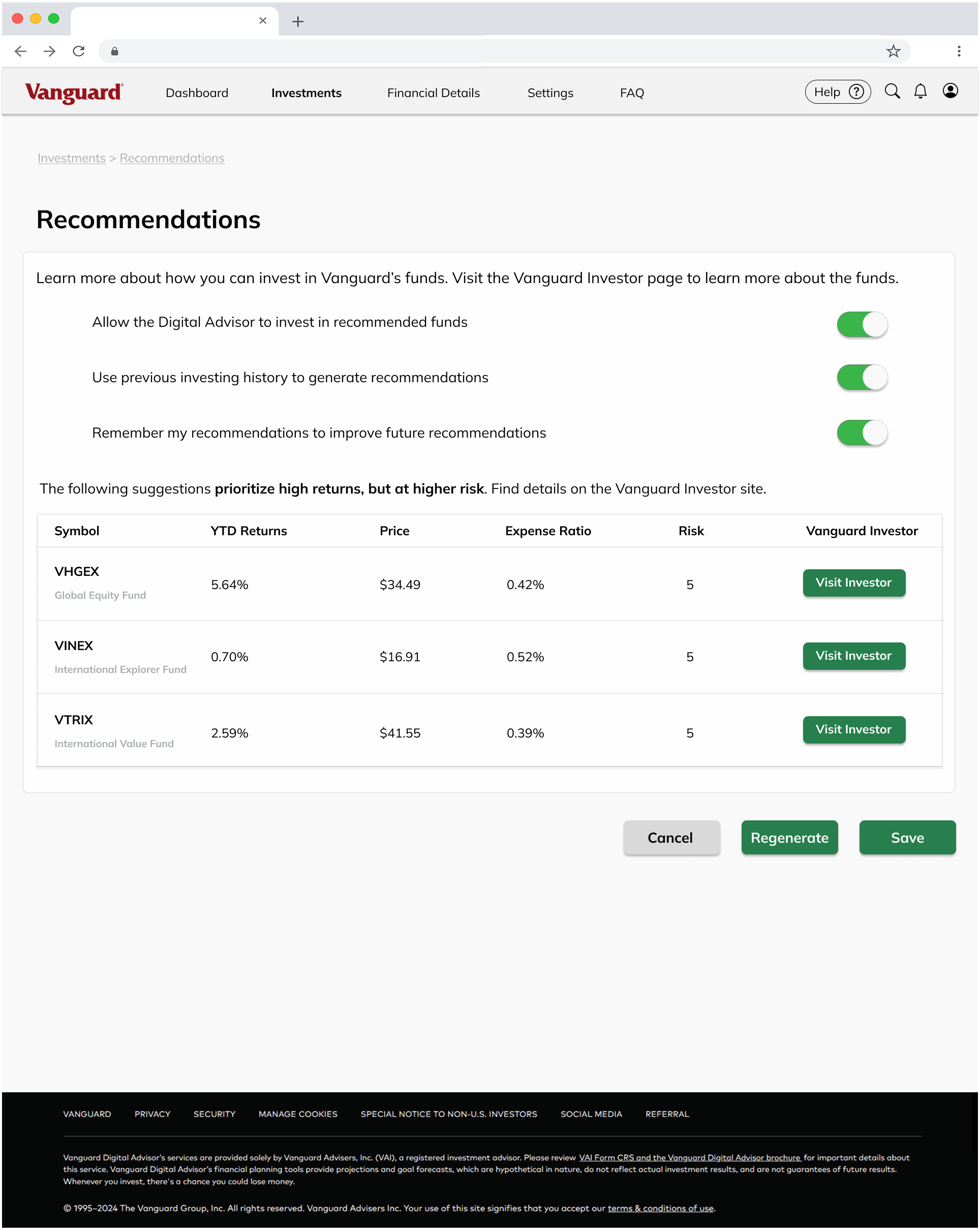

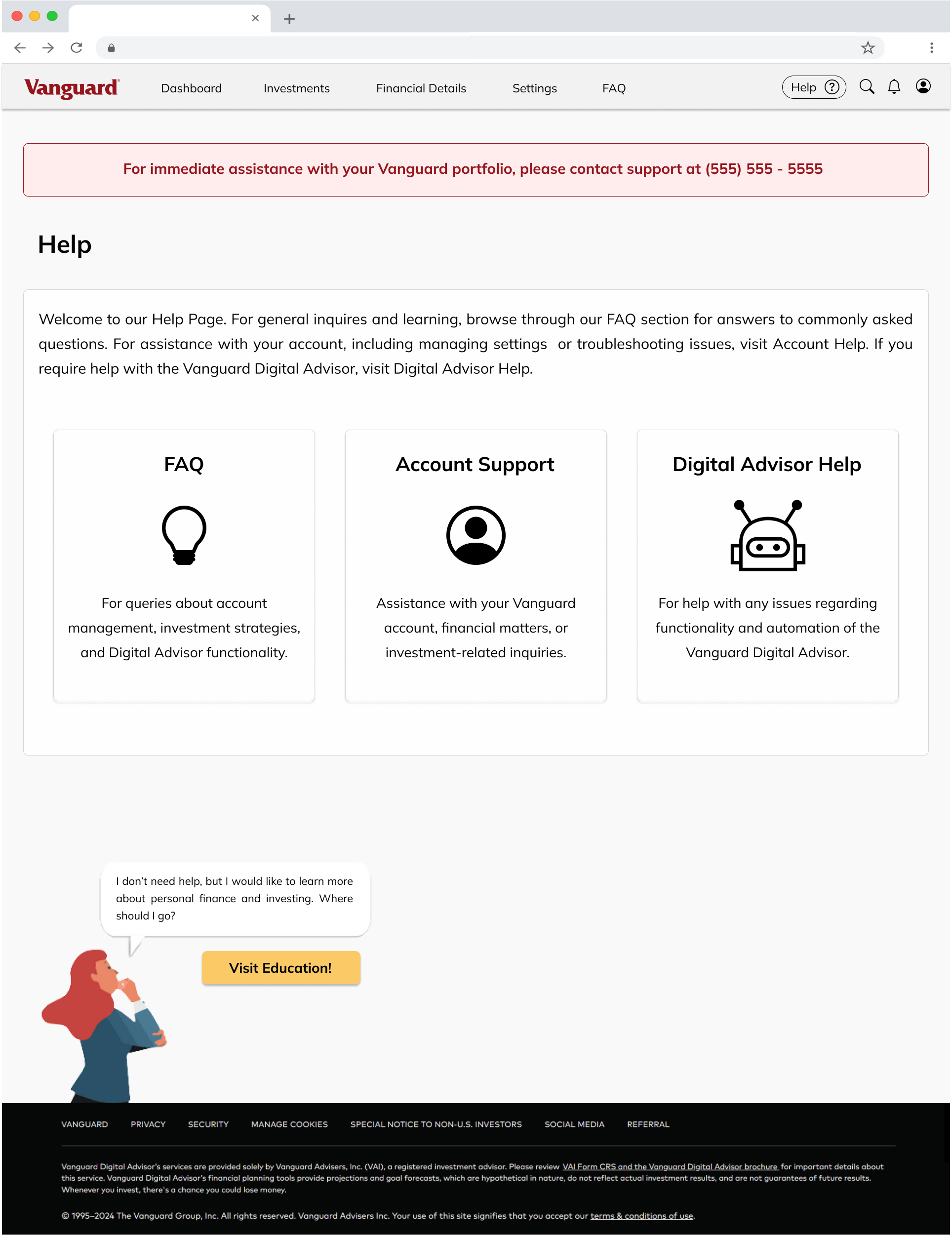

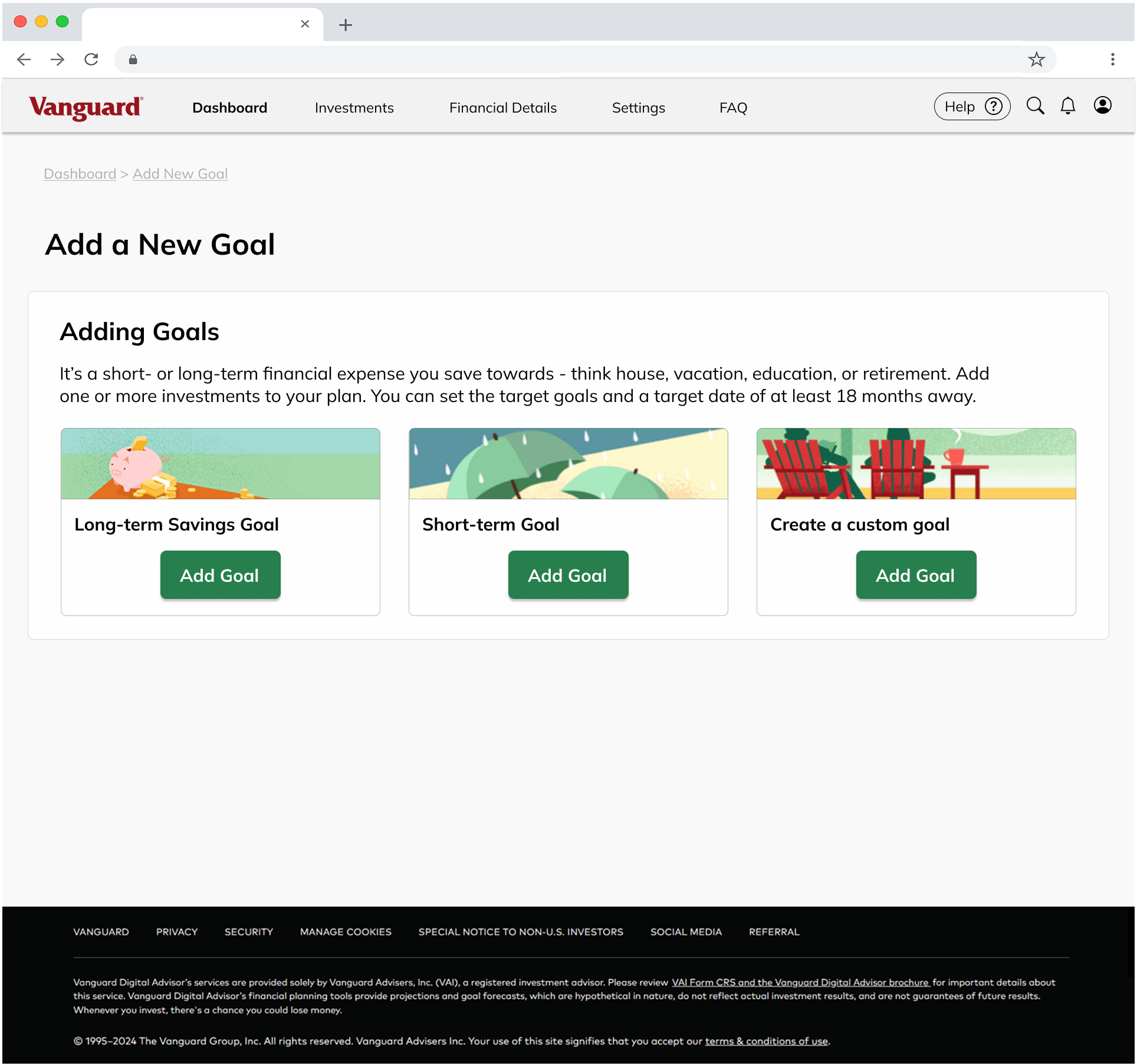

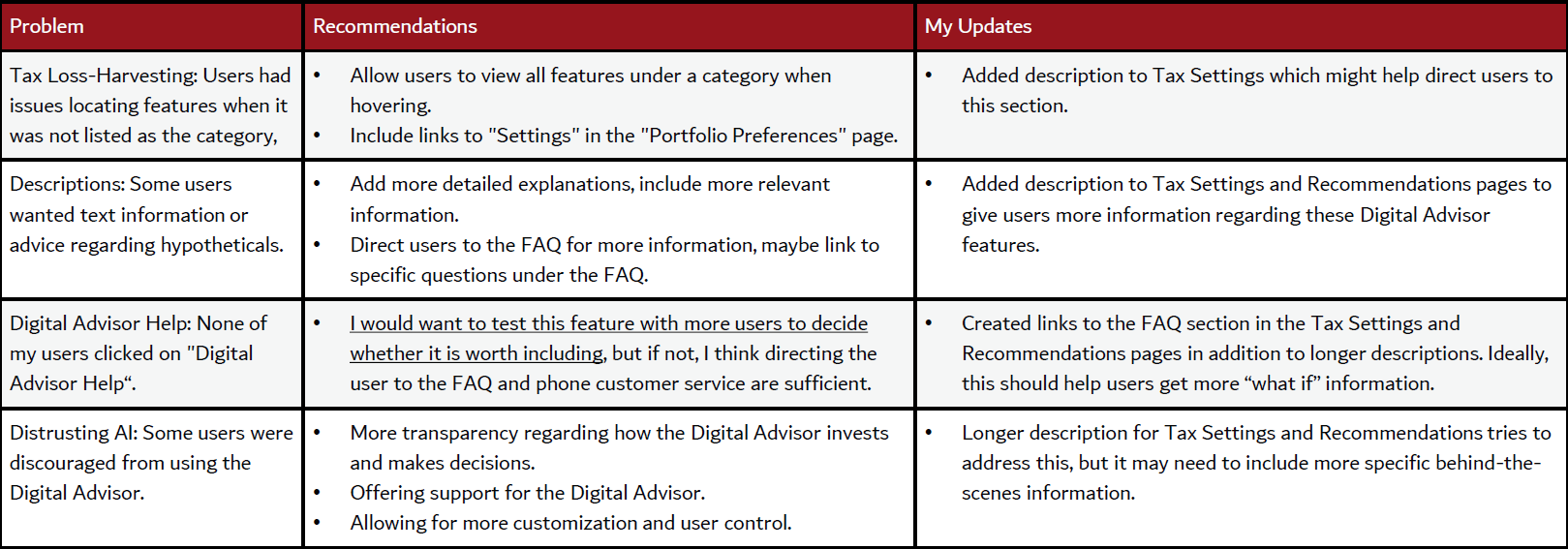

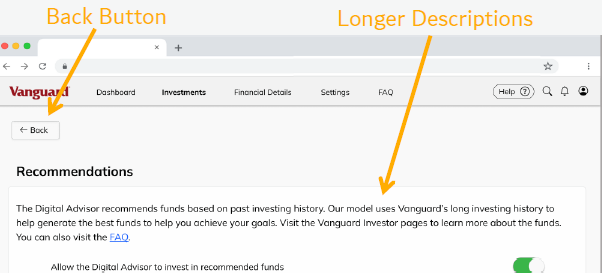

I was tasked with redesigning the Vanguard Digital Investor Dashboard, an AI-driven financial advisor, presented by Lead UX Researcher Steve Schang of Vanguard. Steve walked us through the initial wireframe, outlined the target demographics, and highlighted possible issues in the design. My goal was to create an intuitive, beginner-friendly, user-centered design to improve usability and product approachability.